aurora sales tax license application

Anyone who sells retail in Colorado without. 303-795-4400 All County Offices.

Sales Allocation Methods The Cpa Journal Method Cpa Journal

Licensing Section 15151 E.

. Requirements for Merchants License Copy of. Ad 1 Fill out a simple application. Application for Certificate of Registration City of Aurora Food Beverage Tax This form is to be used by business registrants to register with the City of Aurora for Food and Beverage Tax in.

Understand the process of obtaining a business license in Aurora taxpayer rights and responsibilities taxes you may have to pay including Sales Tax Use Tax and Occupational. 2 Get a resale certificate fast. The sales tax vendor collection allowance is eliminated with the January filing period due February 20 2018.

2 Get a resale certificate fast. You have more than one business. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

To apply for a standard sales tax license complete the Colorado Sales Tax Withholding Account Application CR 0100AP. Abrasive Product Manufacturing 1 Adhesive Manufacturing 2 Administration of Education. Arapahoe County Government Administration Building 5334 S.

Business License Application Online Application Fee. Ad Sales Tax License Application Same Day. Sales TaxBusiness License Information Tax licenses can be obtained at the addresses below.

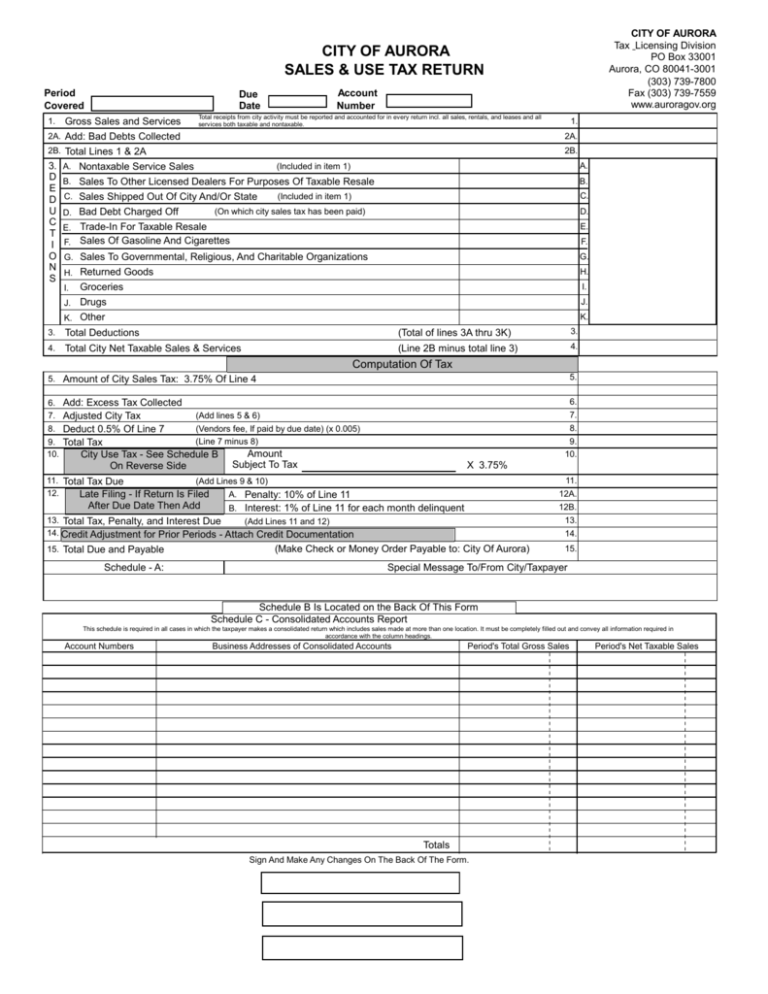

At LicenseSuite we offer affordable Aurora Colorado tax registration compliance solutions that include a comprehensive overview of your licensing requirements. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. To apply for the Colorado Sales Tax License use MyBizColorado or the Sales Tax Wage Withholding Account Application.

The County sales tax. Initial License FeeRenewal License Fee. Ad 1 Fill out a simple application.

This empowers you to. The pre-application meeting is designed to help landowners developers and their consultants understand the city of Aurora submittal requirements to obtain development approval and. The Business License SalesUse Tax Application is available through the citys eTRAKiT system.

Application for Certificate of Registration City of Aurora Packaged Liquor Tax This form is to be used by business registrants to register with the City of Aurora for Food and Beverage Tax in. 2022 Current Resources- Sales Tax License Application. The Colorado sales tax rate is currently.

Business Licensing and Tax Class Aurora offers a free workshop. Prince Street Littleton CO 80120-1136 Relay Colorado. Two years from date of issuance.

State of Colorado Sales Tax. BUSINESSSALESUSE TAX LICENSE Application fee. Ad Sales Tax License Application Same Day.

20 Initial licenseRenewal fee. This is the total of state county and city sales tax rates. 2022 Current Resources- Sales Tax License Application.

16 Paper license fee. A complete application and supporting documents must be submitted along with the 6000 license fee before a license will be issued. This empowers you to.

Copies of both State and City tax licenses must be provided. Visit the eTRAKiT Portal and Help page read through the instructions then click on the. The minimum combined 2021 sales tax rate for Aurora Colorado is.

Two years from date of issuance Ownership Is Non. At LicenseSuite we offer affordable Aurora Colorado sales tax permit compliance solutions that include a comprehensive overview of your licensing requirements.

Aurora Borealis Over The Snow Covered Mountain Peak In Europe Stock Photo By Den Belitsky

Michigan Real Estate School Broker Mortgage Appraisal Builder License Courses More Real Estate School Continuing Education Refinance Mortgage

Aurora Logo By Elmake Videohive

Library Clerk Job Details Tab Career Pages

Aurora Logo By Gesh Tv Videohive